ESG risk hasn’t disappeared because of the COVID-19

pandemic. Unfortunately, some firms have reverted to their Global Financial

Crisis playbook and accidentally opened up a swathe of avenues for criticism.

Environmental, social, and governance risks are particularly acute in a crisis.

Many firms have done a fantastic job of looking after their stakeholders

during this crisis. Unfortunately, others have not been behaving as the good

corporate citizens that exist in their marketing and their annual report

commentary.

The rise of ESG issues over the past decade was reaching its

crescendo at the World Economic Forum in Davos just two months ago. There is no

reason why firms who care about these issues will revert to old habits if they

have embraced managing these risks inside their business in line with community

expectations.

If anything, this current crisis will heighten the level of

scrutiny on everything a company does. Every press release, every employment

decision, every change to a product or service – they will all be under the

microscope.

The level of panic and fear in the community around COVID-19

and its health and economic fallout means that boards and senior executives

need to think carefully about how their actions will be perceived and

interpreted by the community.

Environment Risk

Environment risks include climate change, the natural

environment, pollution, waste, and environmental opportunities for firms to create

a positive impact on environmental outcomes.

Because of the COVID-19 pandemic, and the rise of working

from home, there is a massive opportunity for firms to reconsider their office

space footprint. If remote working is the new normal, customers can still

receive value.

Firms can use a different mix of activities that rely less on

office space, such as video calling. A lower office space footprint will reduce

the firm’s overall environmental footprint as long as business travel remains cancelled

or not possible.

New ways of working across a firm’s end-to-end value chain

will need to consider what other firms in your value chain are doing at the

same time to reduce their environmental footprint.

Social Risk

Social risks include the wellbeing and development of

workers, health & safety, supply chain issues, product design, controversies

and positive social impact initiatives.

The natural response of many firms has been to immediately furlough

workers to reduce costs. If revenue has gone to zero, then cutting costs is obvious.

However, some firms have made responsible decisions – paid sick leave for staff

needing to self-isolate due to COVID-19, paying wages where they can for the

duration of a lockdown, and continuing to pay health insurance premiums.

Some firms are even partnering with organisations in other

industries needing lots of staff quickly to offer opportunities to their furloughed

workers. Health and safety actions are even more critical during this time. The

provision of PPE is essential – if it can’t occur, then boards and senior executives

should think very carefully about whether it is responsible to open at all

without providing this to staff.

The way that some firms have chosen to treat staff is

already causing controversy. On the other side of the bridge, they will face

unfair dismissal claims and litigation from suppliers treated poorly. Other

firms have endeavoured to pay their invoices faster and settle trade creditors

and contractors where possible before closing their operations temporarily.

Governance Risk

Governance risks include corporate governance issues such as

board composition, executive remuneration, shareholding composition and accounting

standards used in financial reporting. Organisational behaviour issues such as tax

policy, ethics, anti-competitive actions and financial stability are risks

here.

Sharing the pain is a smart decision many boards and senior

executives have already taken. Pay cuts and no bonuses are the bare minimum act

of corporate social responsibility if you are standing down thousands of employees.

Firm-wide pay cuts to protect jobs instead of redundancies

can also work here. How many boards have turned over completely since the GFC?

For most, this will be their first major crisis and letting senior managers

deal with the crisis and focusing on governance as opposed to micro-managing

will be a challenge for some.

Board composition needs to be a blend of different experience

and perspectives – how many will have thought through the productivity

implications for their workforce if school kids are at home during this crisis?

Managers being genuine about workplace flexibility where possible will be a differentiator

on the other side of the bridge.

Executive remuneration in the coming years will be even more

sensitive than after the Global Financial Crisis. You see, many people never

thought anything changed after the GFC. If Australia is facing its highest

levels of unemployment since the Great Depression, even the at-risk potential

numbers when it comes to executive remuneration could be a target for regulators.

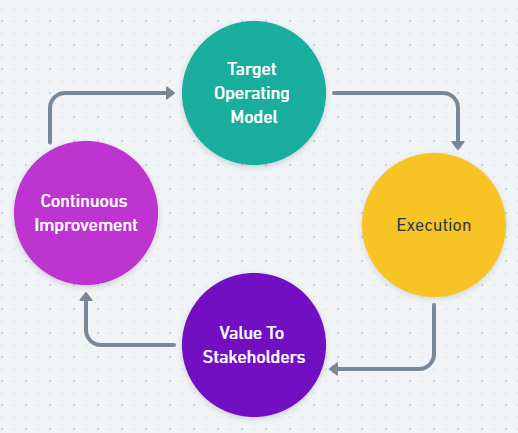

Considerations For Boards And Senior Executives

Boards and senior executives will be under a lot of pressure

right now. Many have invoked their business continuity plan or had to manage

crises non-stop since this pandemic escalated in severity worldwide. A key

consideration at the back of your mind is how stakeholders will perceive the

firm’s actions during this crisis.

Are you doing the right thing by your employees? Are you

doing the right thing by your customers? Are you doing the right thing by your

suppliers and key partners? Are you doing the right thing by your community? In

the age of social media, there will be real-time feedback on the appropriateness

of your actions. In the age of continuous disclosure, your share price will be

gyrating each day based on traders assessment of whether you have this

situation under reasonable control where you can.

A lot of fluff is written about values and corporate social

responsibility. A crisis is where firms that live what they believe and stay

true to their word get to demonstrate to the world their integrity. Customers,

employees, shareholders, stakeholders and the community at large will recognise

that and reward it on the other side of the bridge.

You must be logged in to post a comment.