The spread of COVID-19 and its impact on business means that many firms will be looking at cutting costs. One of the issues with indiscriminately cutting costs is that throughout an organisation, particularly a big and complex one, lots of processes happen every day and they’re not always clean and automated. A lot of documentation, controls and risk mitigation can help you manage your operations, but institutional knowledge kept inside people’s heads is what gets lost during massive layoffs.

Understanding your current operating model pre-pandemic is critical before making any rash decisions. What are the top value streams you deliver to your customers? Are there any that are redundant during these shutdowns? Is hibernation of a business unit or factory location even realistic under such high uncertainty? An operating model can equally apply to a team, a business unit, a division or an entire business group.

The core components of any operating model are the people, processes, and systems that combine to enable capabilities that let a business unit deliver value to its customers.

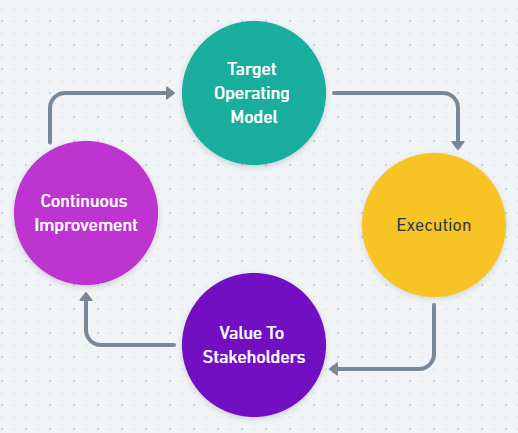

The way a business makes money is by selling the value its capabilities create to customers at a higher price than it costs to deliver that value stream. If any of the three core components are not optimised, there is a risk that competitors will be able to deliver more value for less than you can. Thus, there is a competitive impulse that requires continuous improvement of your operating model.

The capabilities that an operating model enables to deliver value do not exist in a vacuum. Governance of the operating model has to have control and regulatory compliance built into how capabilities are designed and implemented.

The point is that if you want to cut costs during a pandemic, there’s an awful lot of upfront work and analysis that should already be accessible to boards and senior leaders. Your business continuity plan should have different scenarios of “bare minimum” capabilities required. When you suddenly have no revenue, there’s not much point keeping the lights on unless you have a fortress balance sheet and can cope with a few months of zero income.

The operating margin that your business earns drives these decisions. It should not surprise anyone that lower margin industries were the first to shut their doors and layoff staff. If you own a bar that has a turnover of $1,000,000 and a net income of $100,000, then you have monthly costs of $75,000. By definition, you can’t survive longer than six weeks ((100/75)*4.33).

The big policy response question is that if the government has shut you down in the name of public health, is a wage subsidy and the possibility of a select loan going to compensate you for your losses fully? No, it’s not! Business owners and their newly unemployed or stood down workers are partially reimbursed shock absorbers for this health crisis.

Why would a business owner borrow more money from the bank, if they even let them, when there is so much uncertainty? If they have leased premises, and their landlord is obstinate, they aren’t guaranteed to have a rent waiver while the government has closed their doors. That liability is still accruing.

Making changes to safe harbour rules doesn’t change rational behaviour in this situation – when you’re in a hole, you stop digging! Many business owners aren’t even bothering to get JobKeeper because they can use it as an opportunity to make layoffs in the heat of the crisis gambling that Fair Work will never catch up to them.

On the other side of the bridge, your target operating model is going to have to change. It will need to focus on value streams that offer real value to customers and is in line with shifts in consumer preferences in a Great Depression 2.0 environment. It will need to be highly automated and efficient because the competitive pressures on the other side of the bridge will be enormous because of the size of the output gap.

The offshore business processing centres will face pressure to open onshore offices and hire local workers. This risk was already an issue in highly regulated industries, but this trend will spread across the entire economy. The multi-jurisdictional value chain is going to be out of pattern for a while.

This crisis will drive significant changes in the standard corporate playbook. The transformation of your business during and after COVID-19 will require enormous changes in how you do business.

Cost-cutting isn’t just about laying workers off. That’s something anyone with a calculator can figure out. It doesn’t solve your broader business problem – why was your operating model so fragile in the first place? What is your firm’s purpose? Why do you exist? What is your strategy, and how do you design a target operating model that enables the delivery of real value to your customers while keeping a demanding group of stakeholders onside and on your team?

You must be logged in to post a comment.